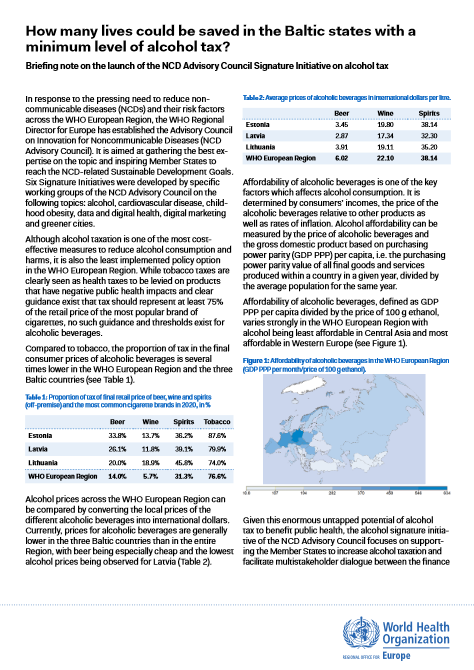

How many lives could be saved in the Baltic states with a minimum level of alcohol tax? Briefing note on the launch of the NCD Advisory Council Signature Initiative on alcohol tax (2022)

8 November 2021

| Technical document

Overview

In response to the pressing need to reduce noncommunicable diseases (NCDs) and their risk factors across the WHO European Region, the WHO Regional Director for Europe has established the Advisory Council on Innovation for Noncommunicable Diseases (NCD Advisory Council). It is aimed at gathering the best expertise on the topic and inspiring Member States to reach the NCD-related Sustainable Development Goals.

Six Signature Initiatives were developed by specific working groups of the NCD Advisory Council on the following topics: alcohol, cardiovascular disease, childhood obesity, data and digital health, digital marketing and greener cities.

Although alcohol taxation is one of the most costeffective measures to reduce alcohol consumption and harms, it is also the least implemented policy option in the WHO European Region. While tobacco taxes are clearly seen as health taxes to be levied on products that have negative public health impacts and clear guidance exist that tax should represent at least 75% of the retail price of the most popular brand of cigarettes, no such guidance and thresholds exist for alcoholic beverages.

WHO Team

Alcohol, Illicit Drugs & Prison Health (ADU),

Office for Prevention & Control of NCDs (MOS)